Understanding property inheritance laws: Essential information for Women's Day

By Bricksnwall | 2025-03-08

Women's Day 2025: This handbook will help women

understand their legal rights by providing information on asset distribution,

will validity, and property inheritance.

It's crucial to consider women's legal rights and

safeguards with regard to inheritance and property ownership as we commemorate

Women's Day. Understanding women's rights in areas like joint property

ownership, succession, and will contestation is crucial even as legal systems

continue to change.

Particularly under Hindu law, inheritance rules

specify the rights of women with regard to the properties in question and

regulate the transfer of property to legitimate successors. Answers to these

questions outline your rights as a woman in property inheritance and

succession, enabling you to make well-informed decisions in both personal and

legal problems, whether you're negotiating the complexity of a shared property,

disputing a will, or trying to comprehend your legal share.

1. Both my spouse and I are employed professionals.

Using our resources and money, we have purchased three freehold joint

properties. We don't have any kids. Do I automatically inherit the properties

if my husband passes away first? What would happen if I died before my spouse?

Your class I legal heirs, you and his surviving mother, will inherit your husband's part of the joint possessions in equal proportion if he passes away before you and leaves no will. Your portion of the joint assets will be inherited by your Class I legal heirs, in this case your spouse, if you pass away before him and leave no will.

2. In 2015, my father, who was Hindu, passed away.

My brother, mother, and I are his only class I legal heirs; he passed away intestate.

What rights do I have over his property under Hindu law?

Since you, your brother, and your mother are the

only Class I legal heirs your father left behind, you will all be entitled to

an equal portion of his assets.

3. I would like to become a co-owner of a freehold

flat that my spouse owns as the sole owner, without having to pay anything

towards this. Is it possible for him to give me his half ownership of the

aforementioned apartment?

A person who is not already a co-owner cannot have their portion of a property relinquished in their favor. Since your husband is the only owner of the aforementioned flat, a gift might be given to you in order to transfer ownership of the apartment in your favor without any payment. To transfer half of the aforementioned apartment to you, he could sign a gift deed. Additionally, the gift deed needs to be properly registered and stamped.

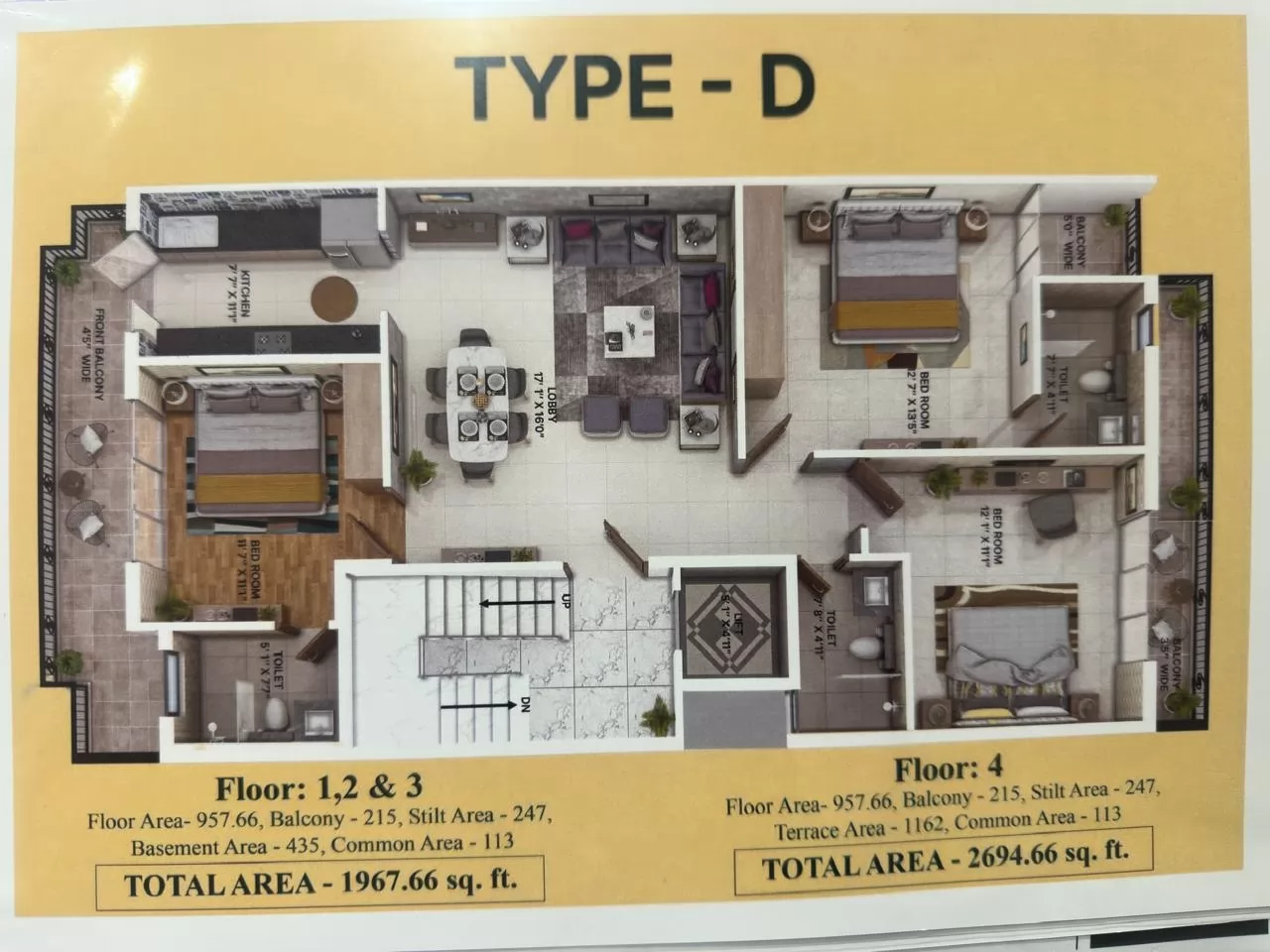

4. My older brother and I intend to buy a fully

built-out residential home that has a terrace, first, second, third, and ground

floors. While I will buy the second, third, and terrace areas, my brother will

acquire the ground floor, first floor, and garden area. Who will be able to

retain the whole property's title documents?

A chain of title records for the entire property will be given to the buyer who buys the more valuable half. However, if the owner of the other, less valuable piece reasonably asks it, the buyer or potential owner is required to provide the title documents for the entire property.

5. In his lifetime, my father submitted my brother

as a nominee in the organization's records for a residential apartment he owned

in a group housing society. My father had passed away before my mother. Is my

brother the only owner of this apartment?

Since you and your brother are currently your

father's only surviving Class I legal heirs, the aforementioned apartment will

be handed to you and your brother, with each of you having an equal and

undivided stake in the apartment, assuming your father left no will. Your

brother's appointment as a nominee in relation to your father's membership in

the society does not grant him any ownership rights over the aforementioned

apartment.

6. Our family is Hindu. My father remarried

following the death of my mother. Due to his second marriage, my father has no

children. I am his only child, along with my sister. What is the inheritance

plan for his properties?

Your sister, you, and your second wife will all

receive an equal share of your father's assets upon his death if he leaves no will.

7. I received a property from my mother that my

brother and I shared. Due to some disagreements, we now want to execute and

record a partition deed in order to divide our interests in the aforementioned

property. Are our inheritance and partition affected in any way by stamp duty?

There would be no stamp duty issues if you had simply inherited this property, as long as you and your brother still own it jointly. Let's say, however, that you and your brother agree to specify who owns what by dividing up the inherited property into separate parts and registering a Partition Deed. Under such circumstances, the relevant stamp duty will be due on the partition deed.

Source: Hindustan Times