Why is a legal heir certificate important, and what does it mean?

Bricksnwall Trusted Experts

People battling in court to maintain their portion

of inherited land or to be named as the property's sole legitimate successor

are stories we frequently read about. But when a real estate owner passes away

intestate—that is, without writing a will outlining their intentions about the

property's distribution—things can become even more convoluted. In these

situations, the surviving family members must obtain formal documents such as

the Succession Certificate or Legal Heir Certificate in order to take on the

owner's obligations and be granted the authority to make decisions on their

behalf.

When it becomes difficult for someone without legal

training to comprehend the Indian Constitution's actions and what all the

technical jargon signifies, they frequently find themselves in a difficult

situation. One such contentious issue that requires clarification is a legal

heir certificate. Learn more about legal heirs and how to obtain a legal heir

certificate by reading on.

As per the laws governing succession, an heir is a

person who inherits all the materialistic goods and duties, including debts

associated with real estate, when the deceased leaves no will or legal

clarification behind.

Legal heirs in India are divided into two groups:

Class I and Class II.

Hindu Succession Law class I heirs in equal share

for a Hindu guy

- His

spouse

- His

offspring

- His

mom

Class II heirs may inherit the property in the

event that Class I heirs are not present.

A Hindu man's class II heirs under Hindu

Succession Law are:

- His dad

- His

offspring

- His

grandchildren by great-grandchildren

- His

siblings

- Additional

family members

A Legal Heir Certificate: What Is It?

In accordance with Indian succession laws, a Legal

Heir Certificate is a crucial official document provided by government agencies

that aids in establishing the relationship between the departed individual and

their legal heirs. All of the deceased person's legal assets are transferred

to their surviving family members with the use of a legal heir certificate

india. Real estate and the transmission of financial claims through banks, such

as provident funds, house taxes, loans, electricity bills, current and savings

accounts, IT return filing, etc., require this certificate. Furthermore, when

an individual passes away intestate—that is, without leaving a will or

designating a legal nominee—a court-issued legal heirship certificate is

required.

Why Is a legal Heir Certificate Required?

The legitimate heir who assumes all of the deceased

person's assets and liabilities claims the Waris certificate. A certificate of

legal heirship is required to

Give a deceased person's belongings and properties

to their legal heir.

Make a claim on any active insurance plans.

sanction and obtain any family pension that the

dead worker's employer received through the proper processes.

Recover financial obligations from the government,

such as gratuities and provident payments.

Acquire any outstanding salary of the departing

worker who was employed by the federal or state governments.

Get hired as a result of any sympathetic

appointments.

It's advisable to request a legal heir certificate

if you're going to buy a property in order to verify who the true owner is.

What Benefits Come With Getting A Legal Heir

Certificate?

A document that attests to a deceased person's

legitimate heirs is called a legal heir certificate. It is a crucial document

that aids the heirs in claiming the possessions and assets the deceased left

behind. Here are some benefits of getting a legal heir certificate in India, thus

you should know how to apply for one:

- Legal

heir certificate: This document attests to the departed person's legal

heirs and serves as proof of legal heirship. To be eligible to receive the

assets and properties that the dead left behind, you must have this

paperwork.

- Simple

asset transfer: Are you still unsure if a legal heir certificate is

sufficient to transfer property? The original legal heir certificate

facilitates the simple transfer of the deceased's estate's assets. To

transfer the properties and assets to the rightful heirs, this certificate

is necessary.

- Prevents

legal disputes: There could be disagreements among the legal heirs

regarding the possessions and assets the deceased left behind if there

isn't a legal heir certificate. The legal heir certificate guarantees a

smooth succession and assists in preventing such problems.

- Helpful

in securing government benefits: The legal heir certificate can be used to

secure government benefits, including insurance, pensions, and other forms

of financial support.

How Does One Go About Obtaining a Legal Heir

Certificate?

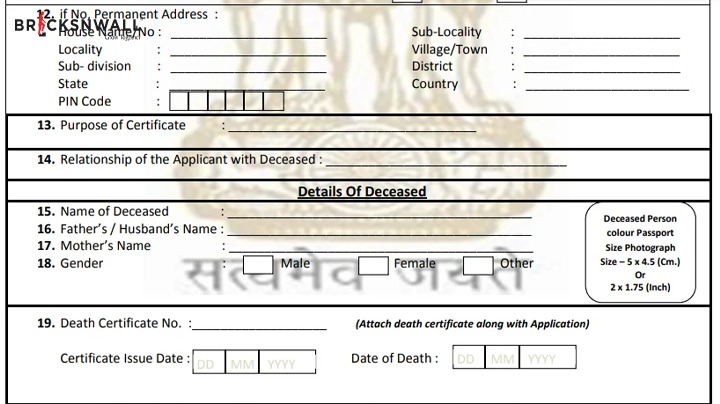

You must get in touch with the district civil

court, corporation/municipality office, or Taluk Tehsildar in the relevant

location to obtain your legal heir certificate.

The legitimate successor of the dead must get in

touch with the appropriate authorities in their area and request the necessary

paperwork to apply for a legal heir certificate. The names, home addresses, and

relationships to the deceased of the legal heirs are all included in the application.

Could you please send this application to the government officials after

filling it out as accurately as possible? For the same, you can also employ an

attorney to represent you at the district civil court.

The application must be submitted with all required

documentation, including the deceased owner's death certificate. The death

certificate needs to be obtained from the corporation/municipality office if

you don't already have it.

The application for a legal heir certificate must

be filed with an affidavit on stamp paper or a self-declaration.

We take note of your inquiry and send an

administrative officer or revenue inspector to get comprehensive information.

The legal heirship certificate was granted by the

relevant authorities as soon as the inspection was finished and deemed

successful.

The time it takes to submit an application and get

the legal heir certificate is typically thirty days. However, you must contact

the Revenue Division Officer (RDO) or the local sub-collector if you encounter

an unavoidable unforeseen delay.

What Records Are Required in Order to Get a Legal

Heir Certificate?

In order to receive a legal heir certificate from

the Indian government, you need to make sure that the application is submitted

with the following documents:

Application: complete, signed, and with correct

information.

- Proof

of address or identity of the applicant. The applicant's Aadhar card,

driver's license, voter ID card, passport, or any other identity card

issued by the Indian government could be used as identification. Any valid

ID, a gas bill, a phone or mobile bill, a passbook, etc., can serve as

address verification.

- The

deceased owner's death certificate. You can get it from the office of the

corporation or municipality.

- Proof

of each legitimate heir's birthdate. It could be a birth certificate,

passport, PAN card, school transfer, leaving certificate, etc.

- Refer

to the owner's proof of death.

- An affirmation of self-undertaking.