Understanding Home Loans for Under-Construction Properties

Bricksnwall Trusted Experts

You've found your ideal home: it's roomy,

conveniently located, and meets all of your criteria. However, there is one

catch: it is currently under development. Disappointed? Do not be! While it may

not be ready for move-in, that should not prevent you from owning your ideal

space.

There are house loans designed specifically for

under-construction properties to assist you make your dreams a reality. Let's

look at the benefits of different loans so you can make an informed decision

about financing your future house.

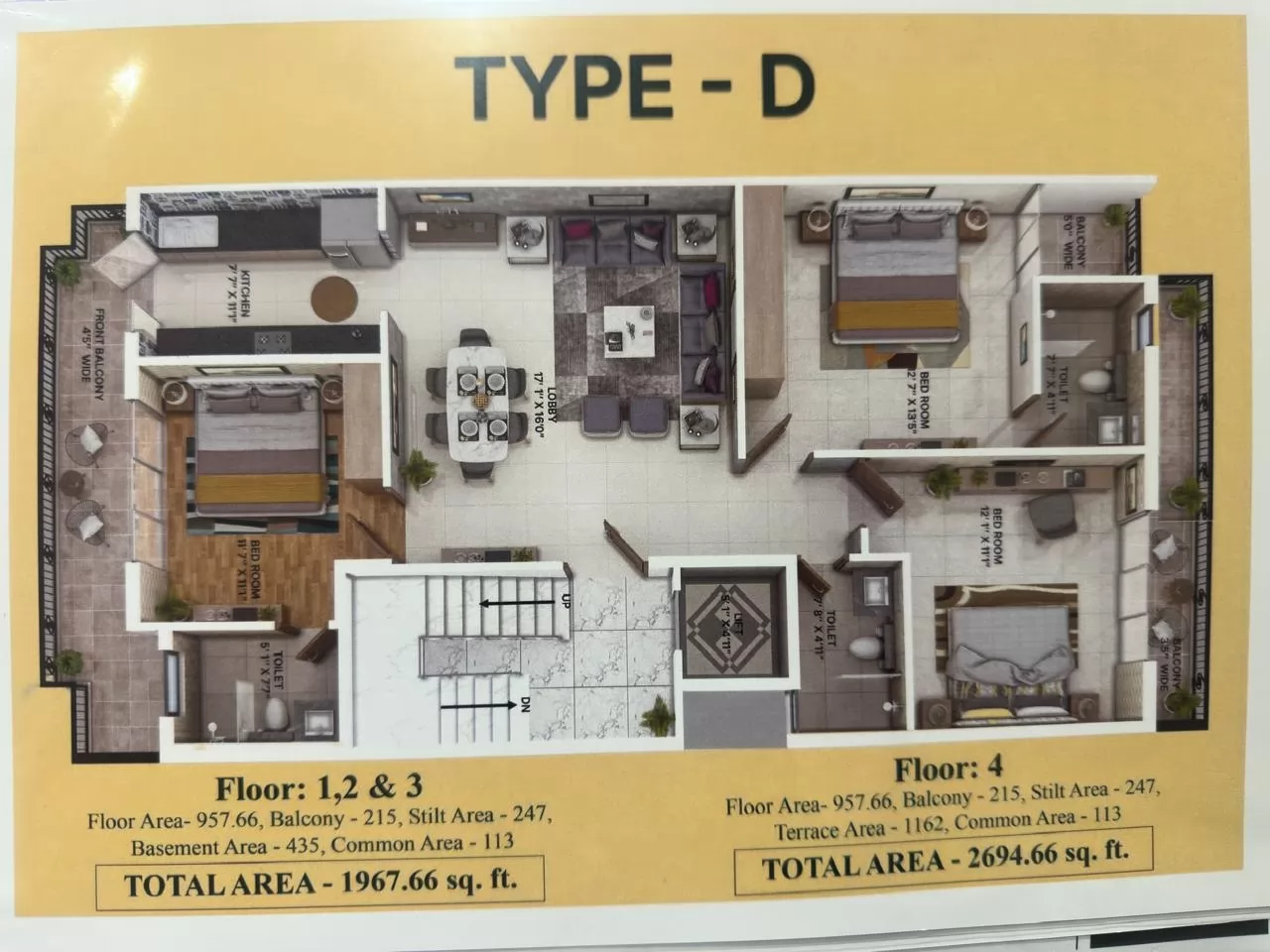

Understanding Under Construction Properties

An under-construction property is a real estate

project that is still being built and has yet to be given over to buyers. When

a person invests in such a property, they are wagering on owning a house once

the development is completed.

Now, let's look at the concept of a home loan for

an under-construction residence. Unlike traditional house loans for

ready-to-move-in residences, these loans are specifically tailored for those

that are actively in development.

They stand out for their unique disbursement approach, in which loan funds are released in stages based on the progress of the property. This phased distribution has an impact on Equated Monthly Installment (EMI) computations and repayments, making it a crucial consideration for prospective borrowers.

Features and Advantages of Home Loans for Under-Construction Properties

When considering a house loan for an

under-construction property, it is critical to understand the specific features

and benefits of this form of financing. Here are some benefits you might expect

when applying for a house loan for an under-construction property.

Affordable EMIs

One of the key advantages of a home loan for under-construction property is that the EMIs are affordable. Typically, once the loan is approved, the lender disburses the funds in installments based on the construction progress. The interest rate is only applied to the amount disbursed, resulting in lower EMIs during the early stages of development. This can also help you manage your budget more effectively and decrease the financial load during the initial phases of your investment.

Convenient interest payments

Another notable characteristic of a home loan for

an under-construction property is the flexible interest payment schedule.

Because you are taking out a loan for a property that is still under

construction, you will only be responsible for the interest until you gain

possession. This is referred to as prior period interest (PPI). When you acquire

possession, the principal amount becomes payable, and your EMIs will comprise

both the interest and principal components.

Flexible repayment terms

Lenders typically provide flexible repayment periods for home loans for under-construction properties. These loans normally have a payback term of up to 30 years, giving you plenty of time to pay it off comfortably. However, it's vital to understand that the lender will consider certain characteristics, such as your age,Before granting the maximum repayment term.

Competitive Interest Rates

Home loans for under-construction properties can

have favourable interest rates, which are typically lower than ready-to-move-in

housing loans. This can result in significant savings over the loan's term.

Maintaining a strong credit score increases your chances of getting an even

lower interest rate, making your investment more financially viable.

Key Factors for Under-Construction Property Home Loans

Under-construction home loans demand a deliberate strategy. When dealing with builders, negotiation is vital. The capacity to negotiate the property price has a significant impact on the total loan amount and, therefore, interest payments. Here are a few additional suggestions to assist you speed the process of securing a home loan for under-construction property:

Do your research

Before committing to an under-construction

property, extensively investigate the area property values and compare them to

the builder's proposed price. This will help you assess whether the investment

is profitable and worthwhile. Furthermore, you should carefully research and

comprehend the terms and conditions of the property transaction to avoid any

surprises or hidden stipulations.

Once you've determined the property's valuation and the terms of the transaction, you should calculate the finances you can contribute and the amount you'll need to borrow for a home loan. This calculator can help you arrange your finances more successfully and avoid exceeding your budget.

Check the Builder's Commencement Certificate

As a prospective property buyer, you must take

caution and scrutinise the builder's legal papers, particularly the

Commencement Certificate. This certificate certifies that the builder has

secured all essential approvals from the relevant authorities to begin

construction on the project.

Possessing a copy of the Commencement Certificate can considerably increase your chances of obtaining a home loan for an under-construction property, as lenders often require this document as proof of the project's validity and legal compliance.

Negotiate the Property's Price

Once you've confirmed the legal features of the

under-construction project, it's best to negotiate the property's pricing with

the contractor. To negotiate a better deal, consider aspects such as the

property's future resale value, accessibility to facilities, and any unique

selling characteristics.

By negotiating a lower price, you may be able to

reduce the amount of home loan you'll need to take out, resulting in cheaper

monthly installments. This can lower the total financial strain and boost the

property's affordability.

Keep track of the construction progress

After obtaining a home loan for an under-construction

property, it is critical to track its progress. Maintain continuous

communication with the builder and home loan provider throughout the

construction process.

This will allow you to ensure that loan

disbursements are made on time and in accordance with building progress. If you

observe any delays or irregularities in the building timeline, you can

immediately urge the lender to suspend further disbursements until the concerns

are remedied. Furthermore, remaining informed and participating during the

construction process can assist reduce potential hazards and keep your

investment on track.

Tax Benefits

The Indian government provides tax breaks when

repaying a house loan for an under-construction property. Section 80C of the

Income Tax Act, 1961 allows a maximum tax deduction of ₹1.5 lakhs on the

principal amount, provided the residential property is not sold within 5 years

of possession. Section 24B of the Income Tax Act, 1961 allows for a deduction

of up to ₹2 lakhs for interest paid on home loan EMIs during the year.

Claiming these tax breaks might help you reduce

your overall tax burden and make repaying your house loan for an

under-construction property more reasonable. Also, contact with an expert or

financial advisor to understand the eligibility requirements and guarantee that

you take full advantage of these tax breaks.

Common Pitfalls To Avoid

While obtaining a home loan for an

under-construction property might be a sound investment option, there are

numerous common dangers that you should be aware of and avoid, including:

Choosing the wrong builder

Choosing a trustworthy builder is as crucial as

obtaining the appropriate house finance for under-construction property.

Borrowers frequently neglect the necessity of working with a reputable and

professional builder, which leads to project delays, cost overruns, and lender

difficulties. To reduce this risk, conduct extensive study and consultations

with multiple builders. Check their track records of accomplishment,

references, and credentials to ensure a successful collaboration.

Insufficient Financial Planning

Building a home is a significant financial

commitment, and lenders carefully consider your financial situation. Many

applicants underestimate the total cost of construction or fail to account for

additional expenses, resulting in a budget gap. To prevent this problem,

develop a detailed budget that includes construction costs, contingency

reserves, permits, and other potential charges.

Incomplete documentation

A home building loan application involves substantial documentation, and many borrowers fail to present all of the required papers. This delay can result in missed deadlines, decreasing your chances of receiving approval. To avoid making this error, gather all necessary documents for the construction loan, such as income statements, proof of employment, tax records, and construction plans, well in advance to ensure a smooth application procedure.

Not reviewing the credit report and score

Your creditworthiness plays a significant role in obtaining a house loan for an under-construction property. Before submitting your application, carefully verify your credit report for mistakes and contest any errors. If your credit score has to be improved, put forth the effort to do so by paying off bills and resolving any lingering concerns.

Not understanding loan terms

The terms and conditions of a house loan for an under-construction property might be complex, jeopardizing your financial stability if missed. You must grasp interest rates, repayment terms, draw schedules, and penalties for delays or defaults. If any details are unclear, request clarification from the lender to avoid unpleasant surprises. You can also study articles and resources to better comprehend the many terminologies related to house loans.

Changing Financial Situation During Construction

Some people make the mistake of changing their

financial status during construction, such as incurring new debt or changing

employment. Lenders check financial soundness throughout the process, and any

significant changes may endanger loan approval. To avoid this, keep your

financial situation stable and avoid making large financial decisions until the

loan is granted and the home development is completed.

- When taking out a home loan for an under-construction property, the EMI usually begins only after the lender disburses the loan amount to the builder in stages as the construction progresses, which means you usually pay only interest ("pre-EMI") on the disbursed amount during the construction phase, and full EMIs (principal and interest) begin once the property is ready for possession; this is often referred to as a "moratorium period" in which only interest is paid.

- There are no tax deductions for home loan interest payments for under-construction residences until the construction is done. However, interest paid during this period can be claimed in five equal installments beginning with the year the construction is completed.

- Yes, you can obtain a mortgage for an under-construction property.

- An under-construction loan calculator is an online tool that helps you estimate the monthly installment (EMI) for a home construction loan. The EMI is calculated utilising data such as the interest rate, mortgage amount, and mortgage length.