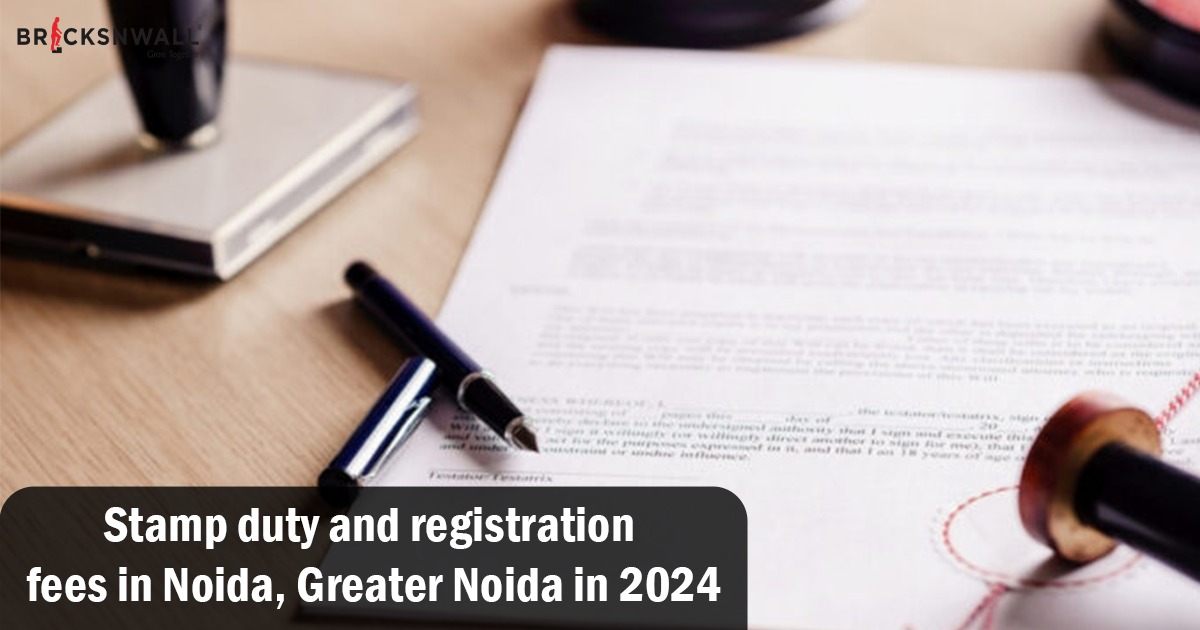

Stamp duty and registration fees in Noida, Greater Noida in 2024

Bricksnwall Trusted Experts

Noida and Greater Noida have seen a significant

increase in residential demand, fueled by large infrastructure improvements

such as Jewar Airport. If you are planning to acquire a house in such an

infrastructure-driven region but are unsure about the taxes to be paid, don't

worry! This article about stamp duty and registration fees in Noida and Greater

Noida will help.

The home-buying procedure is incomplete until it is

registered with the appropriate municipal authority. A property registered in

the owner's name is deemed safe because it cannot be infringed upon. To

register a property, the owner must pay stamp duty and registration fees to the

state's Registration and Stamp Department. These fees are calculated using

either the registered property price or the circular rates/ready reckoner rate,

whichever is higher. The stamp duty and registration rates in Noida are 7% and

1%, respectively.

Follow this guide to find the stamp duty and

registration fees in Noida and Greater Noida in 2024.

Stamp duty in Noida in 2024

|

Ownership |

Stamp duty rates |

Registration fees |

|

Male |

7

percent |

1

percent |

|

Female |

7

percent (minus) Rs 10,000 |

1

percent |

|

Joint

(Male and Female) |

7

percent (minus) Rs 10,000 |

1

percent |

Stamp duty in Greater Noida in 2024

The Uttar Pradesh government levies stamp duty and

registration duties on all properties in Greater Noida, just as it does on

those in Noida. The rates are listed below in the table.

Stamp duty and registration charges in Greater

Noida

|

Ownership |

Stamp duty rates |

Registration fees |

|

Male |

7

percent |

1

percent |

|

Female |

7

percent (minus) Rs 10,000 |

1

percent |

|

Joint

(Male and Female) |

7

percent (minus) Rs 10,000 |

1

percent |

Stamp Duty in Noida and Greater Noida for women

The latest stamp duty levy payable to female homebuyers is 7%. Women who buy a home in Noida or Greater Noida are eligible for a Rs 10,000 stamp duty discount. The registration cost, however, is a percentage that applies to both male and female owners.

How can I pay stamp duty in Noida and Greater Noida

online in 2024?

The online technique of property registration in

Noida is simple and straightforward. The State government charges one percent

of the property's market price or transaction value to register it in Noida.

Follow the steps outlined below to pay stamp duty

in Noida or Greater Noida.

Step 1: Go to the official IGRSUP (Integrated

Grievance Redressal System, Uttar Pradesh) portal. On the left-hand side of the

homepage, pick the "Aavedan Karein" (Apply) option to register as a

user.

Step 2: After registering, a form will appear that

asks you to provide information about your property, such as its size and area.

You will need to attach the relevant documents for evidence.

Step 3: The portal will automatically calculate the

stamp duty for your property in Noida or Greater Noida.

Step 4: Save the acknowledgment slip after paying

the stamp duty and registry fees in Noida or Greater Noida.

If you want to request a refund after making an online payment, please follow the instructions listed below.

Stamp Duty and Registration Charges in Noida,

Greater Noida: Refund by 2024

The following are the methods to get a refund on

stamp duty in Noida and Greater Noida:

Step 1: Access the official IGRSUP (Integrated Grievance Redressal System, UP) portal.

Step 2: To enter the portal, click the New Register

button.

Step 3: Fill in your district, mobile number,

password, and captcha.

Step 4: The new screen will allow you to obtain a

refund of stamp duty and registry payments in Greater Noida and Noida.

Step 5: If you are an existing user, click the

Pre-Register button in the IGRSUP site.

Step 6: To finish the stamp duty refund in Noida or

Greater Noida, you must provide your application ID, password, and captcha

code.

Furthermore, you can verify stamp duty and

registration prices in some of Uttar Pradesh's major cities by clicking on the

links provided below.

Stamp duty and registration charges in

Ghaziabad

Check stamp duty and registration

charges in Lucknow

Check stamp duty and registration

charges in Agra

Check stamp duty and registration

charges in Vrindavan

Check stamp duty and registration charges in Kanpur

How can I find the nearest stamp duty office in Noida and Greater Noida?

Follow these procedures to find your local stamp

duty and registration office in Noida or Greater Noida:

Step 1: Go to the IGRS UP website

(https://igrsup.gov.in/defaultAction.action).

Step 2: On the upper left side of the webpage,

select the 'Know Your Office' option.

Step 3: Select the ‘District’, ‘Tehsil’ and ‘Mohalla/Village’ from the dropdown.

Step 4: Enter the 'Captcha' and then click 'See the Office'.

Step 5: You will

be able to find the nearest office where you may pay stamp duty and

registration fees.

Factors affecting stamp duty in Noida

Multiple factors influence stamp duty prices in Noida or Greater Noida. Some important ones are mentioned below:

Market value of

the property is one of the most important criteria influencing stamp duty

charges in Noida. If your property's market value is high, you will be required

to pay more stamp duty, and vice versa. Furthermore, it is vital to underline

that stamp duty is payable to the higher value between market value and

agreement value of the property.

Gender of the

owner: If a property is registered

in the name of women in India, they obtain a rebate on stamp duty.

Age of the owner: The state governments, including Uttar Pradesh

Location: If the property you intend to purchase is

in a high-value location, you may be forced to pay a higher stamp duty. On the

other hand, if the property falls within Panchayat limits or is located on the

city's outskirts, the stamp duty will be on the lower end.

Type of property: Commercial properties are subject

to higher stamp duty rates than residential ones. This is mostly because

commercial properties provide more room, greater features, and more safety.

Property amenities include the following: The government assesses an additional registration cost for additional amenities given on your property. In Noida, owners are forced to pay an extra charge for more than 20 amenities, including swimming pool, gym, club, and lift, among others.

Stamp Duty in Noida, Greater

Noida: Documents Required

When registering a property in Noida or Greater Noida, make sure to have the following paperwork ready:

Ownership letter: This document is sent by the builder or prior property owner to confirm

the change of ownership.

Loan approval letter: If the buyer

purchases a property with financing, he must present pertinent documents such

as loan statements and permission letters.

Address and Identity Proof: Some documents used as address and identity proof include voter IDs,

driver's licences, passports, and Aadhaar cards.

NOC: When purchasing a property through finance, the buyer must obtain a No

Objection Certificate (NOC) from the bank or financial institution.

Due clearing certificate: This certificate is issued by the builder to indicate the payment and

clearance of any outstanding balances.

Allocation letter or builder buyer agreement: The builder presents the buyer with this document, which details the terms and conditions of the property sale. It must include details such as the possession date, payment plan, and price.

Can you avoid paying stamp duty in Noida and Greater Noida?

The Indian Stamp Act of 1899 and the Registration Act of 1908 require stamp duty to be paid in Noida, Greater Noida, and throughout India. Failure to pay these payments would invalidate your property's registration. Furthermore, it will result in fines of 2% every month and up to 200 percent of the shortfall.

Things to Remember Before Paying

Stamp Duty in Noida or Greater Noida

Before paying stamp duty in Noida

or Greater Noida, here are some important items to remember:

It is ideal to have the stamp

paper in the name of the person who is doing the transaction.

All stamp duty-applicable assets

must be stamped prior to registration or on the next working day after

execution.

The stamp paper shall be no more than six months old from the date of transaction.

Latest information on stamp duty rates and registration prices in Noida

March, 2024

On February 19, 2024, the Uttar

Pradesh government issued an important statement about holding special camps on

Sundays to register blocked housing projects in Noida-Greater Noida. This

effort will be extended to developers who have committed to discharge their

dues in accordance with the recalculations outlined in the Amitabh Kant

Committee report. The Noida Authority expects to register more than 13,000

apartments through these camps. The first camp was put up on March 1 at the

Express Zenith Society in Sector 77, Noida, with many more planned in the

coming weeks.

June 2022

In a recent update, the Uttar

Pradesh government opted to eliminate stamp duty when a property is transferred

to a family member. Previously, a seven percent stamp duty was levied on such

property sales.

This was the second alleviation

granted about stamp duty. Earlier, the Noida Authority declared the stamp duty

computation based on the carpet area of the property. It wrote to the Uttar

Pradesh Stamp and Registration Department to charge homebuyers based on the

carpet area of the residential unit rather than the'super built-up area' to

provide transparency.

The Uttar Pradesh government also

announced increased registration prices for properties across the state, with

the new registration fee set at one percent of the property's cost. The one

percent levy would be levied on properties of all budget levels.

The government charges stamp duty

and registration costs when registering a property. It is critical to

understand the current stamp duty rates and house registration prices in Noida.

Stamp duty charges in Noida are now charged at 7%. In Noida, stamp duty is paid

on all types of buyers, including men, women, and joint property owners (male

and female).

The state government, however, has

offered a one percent rebate on stamp duty for female owners in Noida.

Stamp duty and registration costs are required when purchasing a property in Noida or Greater Noida. It protects you from severe penalties and legalises property ownership. As a result, before investing in these cities, make sure to thoroughly consider the stamp duty and registration costs.