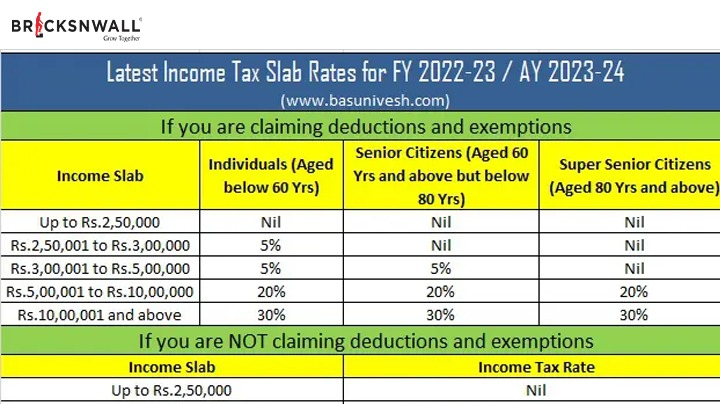

New Income Tax Rates and Slabs

Bricksnwall Trusted Experts

In Budget 2023, Finance Minister Nirmala Sitharaman

made revisions to the income tax slab rates under the new tax system.

The alterations to the new tax structure that have

been announced for the fiscal year 2023–2024, which starts on April 1, 2023,

are as follows: The new revenue regime requires, the minimum exemption amount

to be increased from Rs 2.5 lakh to Rs 3 lakh. The new tax system becomes

taxpayers' default choice.

However, they do have the choice to stick with the

previous tax system. The new tax system has changed the income tax slabs. Under

the new tax system, a standard deduction of Rs 50,000 was made available to

salaried individuals and pensioners. For taxable incomes up to Rs 7 lakh, the

Section 87A rebate rose under the new tax system. If individuals choose the new

tax system in FY 2023–24, they will not be required to pay any taxes if their

taxable income is less than Rs 7 lakh. The highest surcharge rate was decreased

under the new tax system from 37% to 25%.

For FY 2023–2024, the income tax bracket and rates

under the previous tax system stay the same. The deductions and exemptions that

were permitted under the previous tax system remain unchanged as well. If

taxable income does not exceed Rs 5 lakh, a rebate under Section 87A is

available under the previous tax system.

Income tax rates under the new tax system for FY

2023–24 (AY 2024–25)

In the new tax system, modifications to the income

tax slabs have been announced in Budget 2023. The income tax slabs have been

altered to improve the appeal to individual taxpayers. The basic exemption

threshold was increased by the budget from Rs 2.5 lakh to Rs 3 lakh.

The new tax system's income tax brackets are listed

below.

Income tax rates under the new tax law for the

years 2023–2024

|

Income

tax slabs (Rs) |

Income

tax rate (%) |

|

From

0 to 3,00,000 |

0 |

|

From

3,00,001 to 6,00,000 |

5 |

|

From

6,00,001 to 9,00,000 |

10 |

|

From

9,00,001 to 12,00,000 |

15 |

|

From

12,00,001 to 15,00,000 |

20 |

|

From

15,00,001 and above |

30 |

announced adjustments to the new tax code for FY

2023–24

The modifications made to the new tax system to

make it more appealing are listed below:

The new income tax system takes over as the default tax system. Therefore, income will be taxed at the new tax regime's slabs and rates unless a person specifically chooses the old tax system. The Section 87A tax credit amount has increased from Rs. 5 lakh (or Rs. 12,500 in tax credits) to Rs. In fact, this means that those who choose the new tax system and have taxable income up to Rs. 7 lakh will not be required to pay any taxes.

Previously, this tax credit was offered up to a taxable income of Rs 5 lakh. In the new tax system, the basic exemption ceiling was increased from Rs 2.5 lakh to Rs 3 lakh.

There are now only five income tax brackets under the new tax code, down from six. Under the new tax law, a standard deduction of Rs. 50,000 has been made available to salaried individuals and pensioners. Under the new tax law, family pensioners can also claim a standard deduction of Rs.

Under the new tax law, the highest surcharge rate,

previously 37%, has been lowered to 25%.

The new tax system's income tax brackets are in

effect through FY 2022–23 (AY 2023–24).

The income tax slabs under the new tax regime are different from those previously indicated for FY 2022–23 (ending on March 31, 2023) and before.

|

Income

tax slabs in new tax regime till FY 2022-23 |

|

|

Income

tax slabs (Rs) |

Income

tax rate (%) |

|

From

0 to 2,50,000 |

0 |

|

From

2,50,001 to 5,00,000 |

5 |

|

From

5,00,001 to 7,50,000 |

10 |

|

From

7,50,001 to 10,00,000 |

15 |

|

From

10,00,001 to 12,50,000 |

20 |

|

From

12,50,001 to 15,00,000 |

25 |

|

From

15,00,001 and above |

30 |

How to compute the income tax due under the new tax

system

Here is how to determine the amount of income tax

due if you have chosen the new tax structure for the current fiscal year, or FY

2022–23.

Be advised that under the current tax code, only

expenses listed in section 80CCD (2) of the Income-tax Act of 1961 may be

written off. No additional exemptions or deductions are permitted under the new

tax code.

Here is an example of how the new tax system may compute income tax.

Assume that a person would earn Rs 20 lakh in gross

yearly income in FY 2022–2023. Additionally, the company has deposited Rs. 1.5

lakh into the customer's Tier-I NPS account.

He can therefore claim a deduction as a

result under Income-tax Act section 80CCD(2)

How to determine net taxable income under the new

tax system

|

Particulars |

Amount

(In Rs) |

|

Gross

total income |

20,00,000 |

|

Deduction

under section 80CCD (2) |

1,50,000 |

|

Net

taxable income |

18,50,000 |

Therefore, after subtracting Rs 1.5 lakh from Rs 20

lakh, the net taxable income that would be used to determine the amount of

income tax due is Rs 18.50 lakh.

Up to Rs 2,50,000 of income are free from taxation

under the new income tax system. Therefore, there won't be any tax due on this

revenue. After this, there is a balance of Rs 16,00,000 in income that is still

subject to tax (Rs 18,50,000 minus Rs 2,50,000).

The following slab is from Rs 2.5 lakh to Rs 5

lakh. This means that 5% of the sum of Rs 16,00,000 will be taxed, or Rs 2.5

lakh (Rs 5 lakh minus Rs 2.5 lakh). Here, Rs 12,500 in tax will be due.

After this, there is a balance of Rs 13,50,000 in

income that is still subject to tax (Rs 16,00,000 minus Rs 2,50,000). The

following bracket ranges from Rs. 5 lakh to Rs. 7.5 lakh. The subsequent Rs 2.5

lakh (Rs 7.5 lakh minus Rs 5 lakh) from Rs 13,50,000 will be subject to 10%

tax. The amount of income tax due is calculated to be Rs 25,000.

(Rs 13,50,000 minus Rs 2,50,000) The remaining

revenue is Rs 11,00,000. The following income tax bracket ranges from Rs 7.5

lakh to Rs 10 lakh. As a result, 15% tax will be applied to the Rs 2.5 lakh (Rs

10 lakh less Rs 7.5 lakh) of Rs 11,00,000. The tax obligation will be for Rs.

37,500.

The remaining income that is still subject to tax

is worth Rs. 8,50,000 (or Rs. 11,00,000 less Rs. 2.5 lakh). The following

bracket ranges from Rs. 10 lakh to Rs. 12,50,000. The following Rs 2,50,000 out

of Rs 8,50,000 will be subject to Rs 20% tax. The amount of tax due is Rs.

50,000.

(Rs 8,50,000 minus Rs 2,50,000) The remaining

income that is still subject to tax is Rs 6,00,000. Between Rs. 12,50,000 and

Rs. 15,00,000 is the following slab. The subsequent Rs 2,50,000 (Rs 15,00,000

minus Rs 12,50,000) from Rs 6,00,000 will be subject to a 25% tax. The tax

obligation will be for Rs. 62,500.

Currently, the remaining revenue is Rs 3,50,000 (Rs 6,00,000 minus Rs 2,50,000). This will be subject to taxation at the 30% rate for the last tax bracket, or above Rs 15,00,000. The amount of tax due is Rs. 105,000.

|

Calculation

of income tax payable for taxable income of Rs 18.50 lakh |

||

|

Particulars |

Income

(Rs) |

Tax

amount (Rs) |

|

Net

taxable income |

18,50,000 |

- |

|

Income

exempt up to Rs 2,50,000 |

(2,50,000) |

0 |

|

Income

which is still chargeable to tax (Rs 18,50,000 - 2,50,000) |

16,00,000 |

- |

|

Income

tax slab of Rs 2.5 lakh and up to Rs 5 lakh |

(2,50,000) |

@

5% =12,500 |

|

Income

which is still chargeable to tax (Rs 16,00,000 - 2,50,000) |

13,50,000 |

- |

|

Income

tax slab of Rs 5 lakh up to Rs 7.5 lakh |

(2,50,000) |

@

10% = 25,000 |

|

Income

which is still chargeable to tax (Rs 13,50,000 -2,50,000) |

11,00,000 |

- |

|

Income

tax slab of Rs 7.5 lakh up to Rs 10 lakh |

(2,50,000) |

@15%

= 37,500 |

|

Income

which is still chargeable to tax (Rs 11,00,000 -2,50,000) |

8,50,000 |

- |

|

Income

tax slab of Rs 10 lakh up to Rs 12.50 lakh |

(2,50,000) |

@

20% = 50,000 |

|

Income

which is still chargeable to tax (Rs 8,50,000 -2,50,000) |

6,00,000 |

- |

|

Income

tax slab of Rs 12.50 lakh up to Rs 15 lakh |

(2,50,000) |

@25%

= 62,500 |

|

Income

which is still chargeable to tax (Rs 6,00,000-2,50,000) |

3,50,000 |

- |

|

Income

tax slab of above Rs 15 lakh |

(3,50,000) |

@30%

= 1,05,000 |

|

Total

income tax liability |

- |

2,92,500 |

|

Cess

at 4% on total income tax payable (i.e. on Rs 2,92,500) |

- |

11,700 |

|

Final

income tax liability (inclusive of cess) |

- |

3,04,200 |