NDMC Property tax: How to pay house tax online in New Delhi?

Bricksnwall Trusted Experts

The New Delhi Municipal Corporation (NDMC) is a key civic entity in

Central Delhi, responsible for collecting property taxes and upgrading

infrastructure. In an effort to resolve unpaid property tax dues, the NDMC

proposed a refund on property tax payments until September 30, 2024. we have

compiled a thorough guide on how to pay NDMC property tax (online and offline)

and receive a rebate.

The New Delhi Municipal Council (NDMC) levies a property tax on

immovable assets within its jurisdiction. The urban local government analyses

registered properties in its jurisdiction and calculate taxes based on their

kind, age, location, and other factors.

The authority has proposed a five percent discount on property tax

payments for individuals who settle their bills by September 30, 2024. This

rebate also covers servicing payments for government properties. Property

owners can verify their information by entering onto the NDMC website with

their user ID and password.

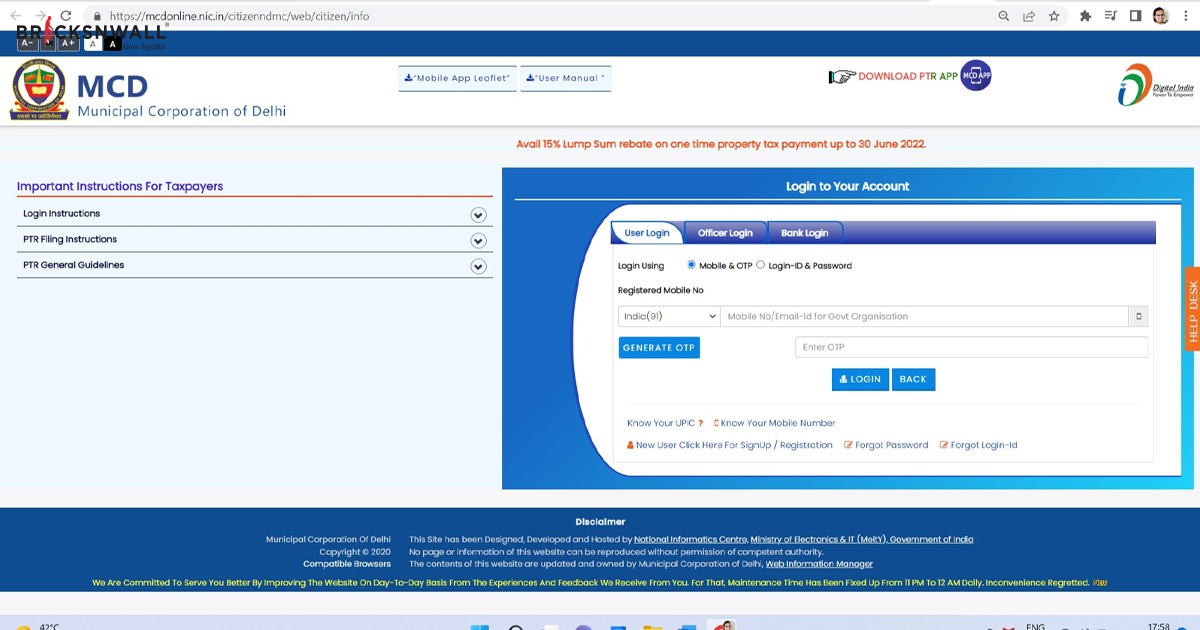

NDMC property tax online: How to pay house tax in New Delhi?

Here's a step-by-step tutorial to paying property taxes online through

the NMDC portal:

Step 1: Go to the NDMC portal and scroll down until you see the property

tax option. When you select the 'Pay' option, you will be taken to a new page.

Step 2: On the next page, enter your login, password, and captcha image.

Step 3: After you've entered all of the required information, click the

login button. You will be taken to a new website with all property tax-related

information.

Step 4: Select a payment option. Get redirected to the payment gateway.

It provides adequate payment choices. You can select a payment method that best

suits your needs.

Step 5: Once the payment has been completed, the site will confirm it.

An acknowledgement receipt will be created. Print the receipt or save a soft

copy to your smartphone or computer.

NDMC property tax: How can I pay house tax in Delhi offline?

To make an offline payment, go to the local municipal department and

provide your property ID. Make sure you have the appropriate documentation for

verification. Once the verification is complete, the overdue property tax is

revealed. You can pay with cash or digital methods accessible at the local

office. You will be handed an acknowledgement receipt with the official seal.

NDMC property tax: How can I check my pending dues?

Property owners can now check their pending property tax bill at NDMC.gov.in. Clicking on the "Check Property Tax Dues" option from the menu will take you to a new page. You may then filter the results by Property ID, Owner name, and address.

NDMC property tax: Areas under its control (2024)

Property owners in the following areas must pay property tax to the New Delhi Municipal Council rather than the Municipal Corporation of Delhi (MCD). The NDMC jurisdiction, also known as Lutyens' zone, encompasses the following areas:

- Connaught

Place

- Mandi

House can be found on Barakhamba Road,

- Gole

Market

- Pandara

Road

- Tila

Marg

- Jor

Bagh

- Kidwai

Nagar

- Moti

Bagh

- Race

Course Road

- Chanakyapuri

- Dalhousie

Road

- Aurbindo Marg

In a nutshell, the NDMC has provided convenient online and offline

payment options for property taxes. The recent five percent refund is an

excellent attempt to encourage homeowners to pay their outstanding bills by

September 2024. So, if you have any outstanding balances, hurry up and take advantage

of the rebate.

- When creating the user ID and password, you must include the property ID and DCR number. If you make a mistake more than five times, your account will be immediately locked for 24 hours.

- Property-related records are registered and stored in the property tax information system (PTIS).