How to pay property tax in Delhi

Bricksnwall Trusted Experts

The government

imposes a tax known as property tax on real estate, which includes land,

buildings, and other constructions. It is a yearly tax determined by the

property's value. One of the main ways that the government raises money is

through property tax, which is then utilized to pay for different city

infrastructure and amenity initiatives.

To avoid fines and legal repercussions if

you own property in Delhi, you must pay property taxes on time. We'll talk

about how to pay Delhi property tax in this article.

Calculate the property tax due.

The first step in paying property tax in Delhi is figuring out how much you owe. The Annual Value (AV) of the property, which is established by the Municipal Corporation of Delhi (MCD), is used to compute the property tax. The size, location, and amenities of the property are taken into account while determining the AV.

By visiting the MCD website and using the

property tax calculator, you can learn the AV of your property. You must input

information about your property, including its kind, location, and area. The

calculator will give you your property's AV when you provide these parameters.

Sign up at the MCD website.

You must register on the MCD website in

order to pay property tax in Delhi. The "New User" button on the MCD

website's home page will allow you to do this. You must enter your personal information,

including your name, address, and phone number.

You will be given a username and password

after registering, which you may use to access the MCD website.

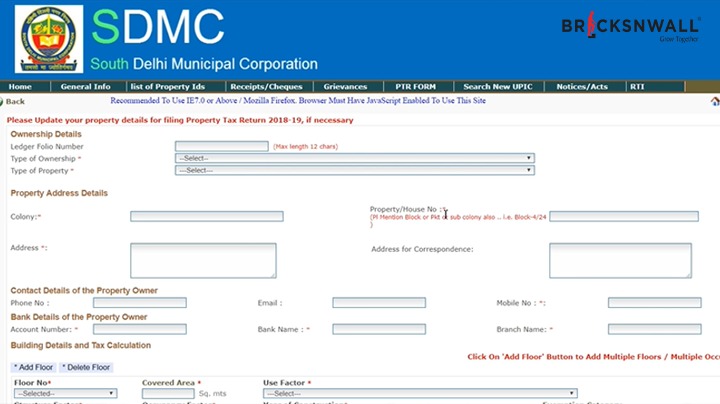

Complete the real estate tax form.

You must complete the property tax form

after logging into the MCD website. You must fill out the form with information

such as your contact information, address, and property ownership information.

The property tax calculator can be used to determine the AV of your property,

which you will also need to enter.

Determine the property tax due.

The MCD website will compute the property

tax amount based on the AV of your property once you have completed the

property tax form. For residential and commercial properties, the rate of the

property tax is 12% and 20%, respectively.

Pay the invoice.

You can pay the property tax using one of

the several methods offered on the MCD website after figuring out how much it

will cost. Using your debit or credit card, net banking, or a mobile wallet,

you can choose to pay the tax online. By making a payment in person at the

nearby MCD office or bank, you can also pay the tax offline.

Take a look at the property tax receipt.

The property tax receipt must be obtained

once the payment has been completed. By entering your account on the MCD

website and selecting the "Print Receipt" button, you can download

the receipt. You can also get a hard copy of the receipt by going to the nearby

MCD office.

Conclusion

It is important to be aware that the MCD charges a late payment penalty for property taxes. A penalty of 1% per month on the outstanding amount will be applied if you don't pay the tax by the deadline. To prevent these fines, it is imperative to pay your taxes on time. Additionally, if you pay your property tax by the due date, the MCD will give you a refund. Depending on the type of property and the date of payment, this refund can be between 10% and 30%. Additionally, it's crucial to safeguard your property tax receipts, which serve as documentation of tax payments. These receipts may be required for a variety of reasons, including when selling the property or making a loan application. If you need assistance paying your property tax, call the MCD hotline or go to the location that is most convenient for you. Property owners in Delhi have a significant obligation to pay property taxes. You may help the city build and maintain its infrastructure and municipal facilities by following the instructions above and paying the tax on time.