How to pay PCMC Property Tax 2024?

Bricksnwall Trusted Experts

The PCMC Property Tax is a yearly tax that property owners must pay to the Pune-Chinchwad Municipal Corporation (PCMC). Property owners are required to pay the corporation a half-yearly PCMC Property Tax, which can be done online. The PCMC was among the first civic entities to collect PCMC Property Tax digitally.

How do I compute PCMC Property Tax 2024?

It is simple to calculate the PCMC property tax

online amount for your property in the PCMC area using a calculator found on

the PCMC's official website. Here is a step-by-step approach for calculating

your PCMC tax.

Step 1: Go to the PCMC Property Tax-Self Assessment

portal.

Step 2: Select the zone and scroll down to compute

property taxes as a resident, NRI, or for commercial property.

Step 3: Choose the sub-use type, construction type,

and type for the property area.

Step 4: The property tax amount will be computed.

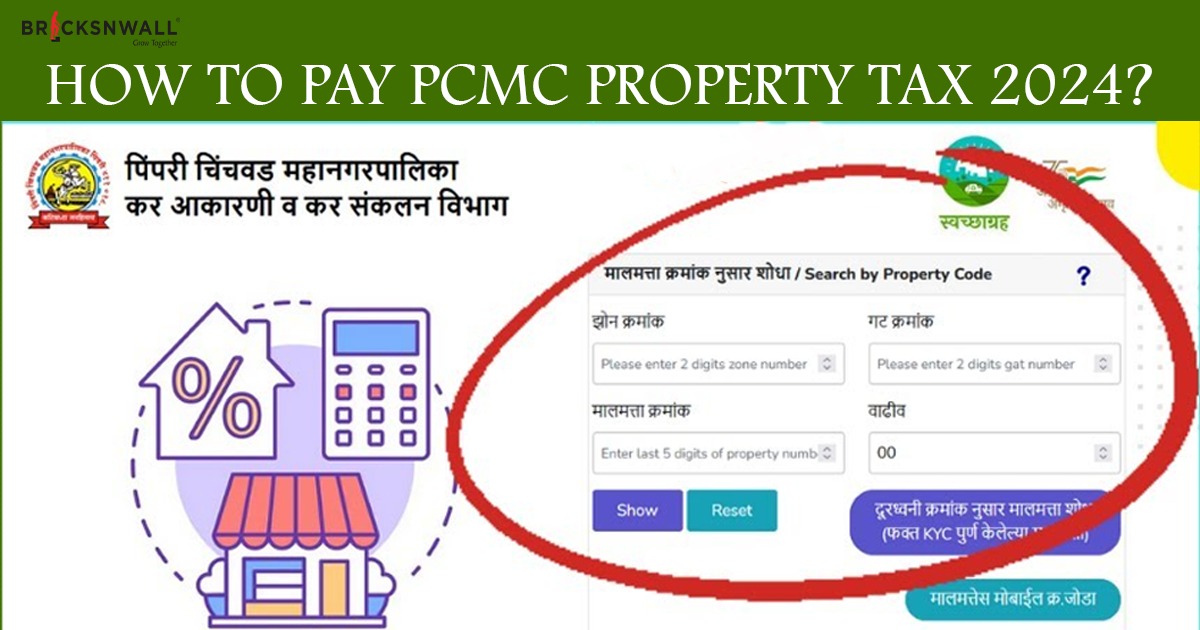

Steps to view your PCMC Property Tax bill online:

To access your PCMC Property Tax bill, go to the

PCMC India page and click on 'Resident' in the top menu.

Enter the property id number or mobile number and

then click on search.

You must input property information, including the

zone number, Gat number, and owner's name.

To view your PCMC property tax bill, click on the 'Show' option.

Look for 'Total Amount to Pay (Amount with Concession-Fajil Amount)' on the property tax PCMC bill. This is the amount required for PCMC Property Tax payments from April to September and October to March. You can also download the PCMC Property Tax bill.

What documents are necessary to pay PCMC Property Tax?

Please include the following information: owner

name, contact number, address, property ID, and bank or card payment details.

How do I pay the PCMC Property Tax 2024 bill

online?

Access http://propertytax.pcmcindia.gov.in:8080/pcmc/. Click here to pay your property bill online.

Enter a property number or a mobile number and

click Search.

Once you've reviewed your bill, go to pay it using any of the online payment options.

How can I pay PCMC Property Tax 2024 online using Paytm?

Follow these procedures to pay your PCMC property

tax bill online with Paytm:

- Select a corporation.

- Fill in the required information, such as the

property ID, name, address, email address, and phone number.

- Click 'Get Tax Amount'.

- After you've checked the payable tax amount,

choose your preferred means of payment: debit card, credit card, net

banking, or UPI (UPI is only available with the Paytm app).

- Proceed with the payment, and you're done.

What are the issues you may encounter when paying PCMC Property Tax online?

Payment Failure: This could happen if there is a

server fault on the bank's end or if there is insufficient funds in the bank.

Technical failure: Many times, you may be unable to

complete the payment due to technical challenges with the PCMC website.

inaccurate information: If you enter inaccurate property id data or other essential information when paying the PCMC Property Tax, there will be a payment error.

What to do if a PCMC Property Tax receipt is not generated?

If the receipt is not generated on the PCMC website

due to a technical issue while making a PCMC property tax online payment, check

your bank account and make the necessary payment.

If money is deducted from your bank account but your property tax receipt is not displayed, it will take three business days for the PCMC receipt to appear on the PCMC property tax website.

How do I pay PCMC Property Tax offline?

You can pay the PCMC Property Tax offline by going

to the local ward office near your property.

Fill out the application form and attach supporting

papers.

Pay the bill and receive the acknowledgement.

When is the deadline for making the PCMC Property Tax 2024 payment?

The PCMC Property Tax can be paid in two instalments. The first for the period (April to September) must be paid by May 31, and the second (October to March) by December 31. Starting October 1, the PCMC will levy a 2% late fee on people who failed to pay the PCMC Property Tax for the period of April to September.

How do I alter the name on my PCMC Property Tax account?

The process of changing your name in the official PCMC property tax record is straightforward and may be completed by the applicant if all required documents are present. Keep the following documents handy:

- Latest property tax receipt.

- Attested copy of the sale deed, which should

be in the applicant's name.

- No-objection Certificate from the Housing

Society.

- Application form, which is accessible at the

property tax office.

Fill out the application form and submit it to the Commissioner of Revenue at the PCMC office, together with the documentation listed above. The application will be confirmed, and the records will be updated within 15-20 working days.

How to file a complaint about PCMC Property Tax?

The Suvidha platform allows all citizens to file concerns about the Pimpri-Chinchwad Municipal Corporation. To submit a complaint on the platform, users must first register themselves. The portal can also be used to monitor the status of complaints. The Suvidha site allows users to make complaints about property tax, water tax, construction plan approval, civil works, and public establishment systems.

What properties are excluded from paying the PCMC Property Tax?

- Properties used for religious worship, public

burial or cremation, and heritage land.

- Any structure utilised for philanthropic,

educational, or agricultural purposes.

- Residential constructions of fewer than 500 square feet.

PCMC Property Tax: Contact Details

While the PCMC property tax payment process is easy

and user-friendly, the payee can contact the civic body if there are any

complications.

PCMC Sarathi Helpline Number: 8888 00 6666.

- When is the deadline for making the PCMC Property Tax 2024 payment? The PCMC Property Tax can be paid in two instalments. The first for the period (April to September) must be paid by May 31, and the second (October to March) by December 31.

- Go to the PCMC portal and select Property Tax. Input the zone number, owner's name, and GAT number. A property bill based on the information supplied will be displayed.

- If you are unclear of your Property Identification Number (PID) or Survey Number, you can look up your property tax information on the PCMC website using your name. The website's search feature enables property owners to get their property tax details by entering their name and other relevant information.

- PCMC grants a 5% to 10% reduction on general tax to property holders who make advance payment of property tax for residential and non-residential/industrial/mixed buildings.