Bhulekh Bihar (2023): How to Check Land Records Online

Bricksnwall Trusted Experts

The Land Revenue Department of Bihar maintains land records for the entire state through land records and surveys. Under the Digital India initiative of the Central Government, land records for Bihar are uploaded online and can be easily accessed by users from anywhere, anytime, without standing in line at the local revenue department office.

What data is accessible through the Bhulekh Biharportal? The following details are available to users on the Bihar Bhoomijanakari and Bhulekh Bihar portals:

- Khatian Cadastral Survey

- Regrouping Khatian

- Khatian revision survey

- Register for jamabandis

- Registry of real estate

- Suit registration data

- Register for transmutations

- Village revenue map

- Switching records

- Correction for the Stored Register of Change

- Registry of land settlements

- A land acquisition record

- Mango Non-Majrua

- Land Register for Khas and Kaiser

- Register of Land Settlement and Delimitation

- record of land delineation

- Register and Record for Site Settlement

- Register for Vasal Farm Records

- Records from Vassal Farm

- Keep a copy of any letters, circulars, resolutions, and notifications that the state government has issued.

- Register and Record for Land Measurements

- Registered Sairat

- Case Register and Record for Land Encroachment

- Bhoodan

- Record in the Sairat Settlement Register

- Ground rent calculation and settlement of registered documents

- Mahadalit Land Acquisition

- Records of the Waqf Board, the Religious Trust, the Cemetery, and the Crematory

How to use the Minimum Value Register (MVR) to determine the value of land in Bhulekh, Bihar?

The Minimum Value Register (MVR) feature, which can be utilized to find out the plot price depending on location in the state, was launched to assist land owners in Bihar in determining the actual value.

How can I view my MVR online?

Step 1: Go to the MVR Bihar Bhumijankari Portal website.

Step 2: Submit the necessary data, including registration Office, Circle Number, Thana Code, and Land Type.

Step 3: To submit the information, the MVR detail will be presented on the screen.

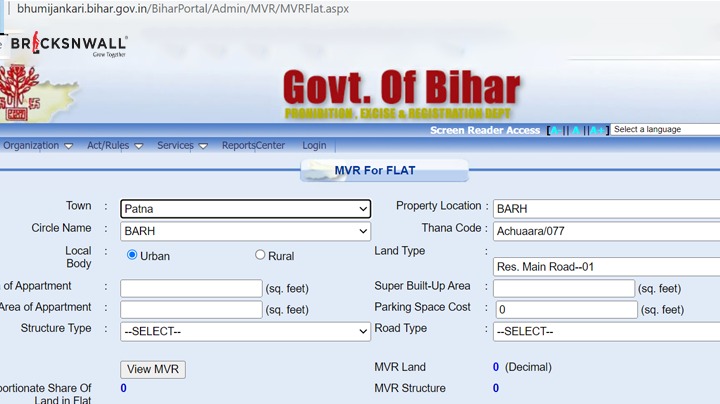

How can I check the Bihar Flat MVR online?

On the BhoomiJankari website, users can view the flat MVR as well.

Step 1: From the drop-down menu under "Services" on the Bhumijankari portal (bhumijankari.bihar.gov.in), select "View Flat MVR."

Step 2: Enter the necessary information, including the town/city, address, thana code, plot, total square footage of the flat, etc.

Step 3: To view the price analysis, click on 'ViewMVR'.

How do I view a bhumijankari.bihar.gov.inencumbrancecertificate for Bihar?

Step 1: Go to the Bhumijankariportal(bhumijankari.bihar.gov.in) and select the 'View Land Transactions from the menu labeled 'Services'.

Step 2: Provide the necessary information as shown here, then click "Show the transaction."

How can I check the Khasra-Khatauni in Bhulekh, Bihar, online?

On the online Bhoomijanakari portal, you can view the specifics of the Bihar Khasra-Khatauni.

Step 1: Go to the Jamabandi Register link on the Bihar Bhoomi information portal (biharbhumi.bihar.gov.in//Biharbhumi/).

Step 2: Enter the necessary data, such as the district and village names.

How to Pay Tax Online in Bihar on the BiharBhoomiPortal?

The digitization of land records has made it much simpler for Bihar residents to pay taxes online. On the official Bihar Bhoomi website, taxpayers and landowners can quickly check their land tax(lagan)liability as well as submit an online tax payment. There is some difficult income terminology in Hindi, despite the fact that the majority of the web pages can be translated into English. To ensure seamless completion of the requirements, users should be fully informed of what these terms signify.

Step 1: To pay BiharLand Tax online, go to the official website, Bhulagaon.

Step 2: Click the 'PayOnline Lagaan' option.

Step 3: Enter the required details like DistrictName, Halka, Mauza, Zone, etc.

Step 4: The user must select the search tab after providing the information and security code.

Step 5: Selecting the tab will bring up the information listed below regarding the tax liability of the land.

Bihar's outdated land records should be updated: Parimarjan

Landowners can use the Parimarjan option on the Bihar Bhoomijanakari portal to amend errors in outdated land records.Parimarjanis Hindi for "correction." On the Bhulekh Bihar portal, users can submit applications for any corrections to their land records. Using the application ID generated on the site, the application can also be monitored after the user submits it successfully. The Land Revenue Department may request more documentation from the user in order to correct the error.

The Bihar Bhoomijankari Portal offers the ability to instantly locate the state's land records. In addition to this, he assists with other tasks like figuring out how much the plot and flat will cost. The advantages of document digitization are plain to see. Therefore, users and state residents must make use of these resources to maintain the most recent versions of their land records at all times.