An E-Stamp: What is it?

Bricksnwall Trusted Experts

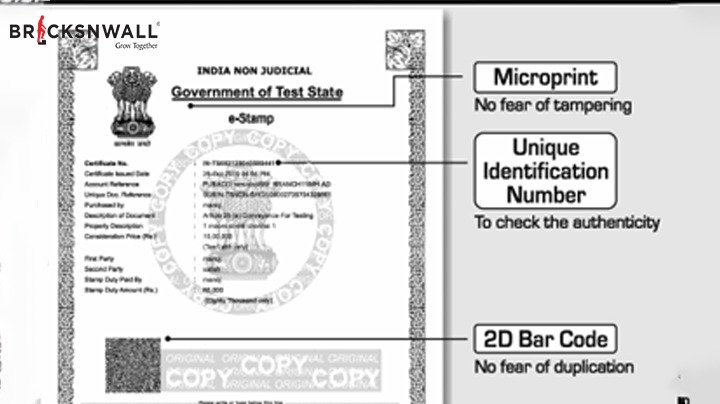

An electronic stamp is created when the complete stamp paper purchase

procedure takes place online and no actual stamp paper is needed.

India's E-stamping

In an attempt to lower the number of errors and counterfeits, the Indian

government implemented the e-stamping service starting in July 2013. For all

e-stamps used in the nation, the Central Record-Keeping Agency (CRA) is the

Stock Holding Corporation of India Limited (SHCIL). The SHCIL is licensed to

handle everything from user registration and administration to e-stamping

applications and record maintenance. Additionally, it has authorised collecting

centres, or ACCs (scheduled banks), which provide certificates to those who

request them.

E-stamping advantages

The e-stamp certificate can be generated quickly with e-stamping.

The e-stamp certificate has a unique identifying number (UIN) and is

unchangeable.

It is possible to confirm the authenticity of the e-stamp certificate by

using the inquiry module.

A particular denomination is not required for e-etamping.

What is the function of SHCIL?

India's top depository operator, Stock Holding Corporation of India

Ltd. (SHCIL), was established as a public limited company in 1986.

SHCIL is a subsidiary of IFCI Limited, which, as of March 31, 2019, is

owned and promoted by all Indian banks and financial institutions, including

IFCI Ltd, LIC, SU-UTI, GIC, NIA, NIC, UIC, and TOICL. IFCI Limited also

maintained a 52.86% share in the company.

SHCIL is credited with "pioneering the Demat services in

India" and e-stamping services, which have simplified government payments.

It also serves as the main organisation for e-stamping record-keeping.

Clients of SHCIL include IDBI MF, LIC MF, GIC MF, SBI MF, Shriram MF,

Sundaram MF, Oriental Insurance, New India Assurance, National Insurance, and

United Insurance. SHCIL is one of the pioneers in the depository services

industry, with more than 6,50,000 accounts under management.

SHCIL electronic certification

The only central record-keeping agency (CRA) that the Indian government

has selected is SHCIL. The management of imprest balances, user registration,

and general e-Stamping application operations and maintenance fall under the

purview of the central record-keeping agency.

Citizens can print e-stamp certificates and pay stamp duty online from

the comfort of their homes by using the SHCIL e-stamping services.

Additionally, Authorised Collection Centres (ACCs) are appointed by SHCIL, and

at their counters, ACCs provide certificates to clients.

There are various ways to pay stamp duty in the electronic stamping

system

The client has the following options for paying the stamp duty amount:

Cash

Check

Demand Draft

Payment Order

RTGS

NEFT

Transfer from one account to another

How can you e-stamp your documents?

First step: Check out the SHCIL's official website at

https://www.stockholding.com/. After selecting "e-Stamp services,"

click on "products and services," and then pick

"e-Stamping."

It will be indicated on the webpage if e-stamping is permitted in your

state. As of right now, the NCT Delhi, Gujarat, Chhattisgarh, Karnataka,

Himachal Pradesh, Odisha, Tripura, Ladakh, Chandigarh, Jammu & Kashmir,

Puducherry, and Andaman & Nicobar Islands can generate an e-stamp

certificate online. The SHCIL has emphasised that residents should utilise the

facility wherever it is available in light of the COVID-19 pandemic.

Step 2: From the drop-down list, choose the state. We have chosen the NCT

of Delhi in the example.

Step 3: You must complete an application. Navigate to the "Downloads"

tab on the webpage and choose the necessary application. Assume that the

application in question is the one for which the stamp duty payment is under Rs

501. Just fill out the form after downloading it.

Step 4: In order to receive the stamp certificate, you must send this form

and payment.

List of states with e-stamping facility

- Andaman

and Nicobar Islands

- Andhra

Pradesh

- Assam

- Bihar

- Chhattisgarh

- Chandigarh

- Dadra

and Nagar Haveli

- Daman

and Diu

- Delhi

- Gujarat

- Himachal

Pradesh

- Jammu

and Kashmir

- Jharkhand

- Karnataka

- Odisha

- Puducherry

- Punjab

- Rajasthan

- Tamil

Nadu

- Tripura

- Uttar

Pradesh

- Uttarakhand

How can I pay the electronic stamping stamp duty?

Cash, checks, demand drafts, pay orders, RTGS, NEFT, and even

account-to-account transfers are all acceptable methods of payment for stamp

duty. You can pay with cash, a cheque or a debit card at an ACC.

What distinguishes franking from electronic stamping?

When you purchase a property, your state may charge you stamp duty.

Stamping property documents, on the other hand, is known as franking.

Authorized banks will use franking to stamp your document or apply a

denomination, which serves as evidence that the transaction's stamp duty has

been paid.

Related Searches

Click Here to Know about - An Overview of Property vs. Real Estate Taxes