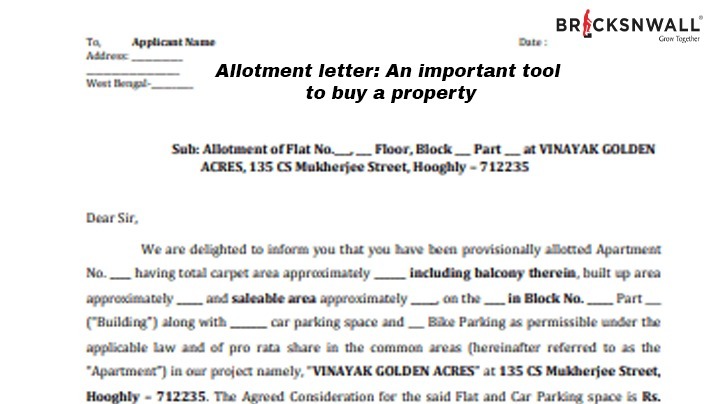

Allotment letter: A vital tool to buy a property

Koheli

A government

or other body may grant permission to purchase real estate by issuing an

allotment letter, a legal document. It must be obtained before buying a home

because it is a legally binding document. The buyer's name, the property's

address, the amount of money required, and the deadline for the purchase are

often included in the allotment letter. It also acts as evidence of property

ownership.

A

closer look at what an allotment letter is

When

purchasing a property, an allocation letter is a crucial document. It is an

official document that spells out the contract details between the buyer and

the seller. The property's developer or builder issues the allocation letter

serves as the buyer's evidence of ownership and payment.

An

explanation of an allocation letter's purpose and significance in the property

purchase process is provided below.

Buy

Intention Confirmation: An allocation letter serves as a purchase

intention confirmation for the buyer. It summarises the agreement's specifics,

including a property description, payment plan, and other terms and conditions.

Evidence

of Ownership: The allocation letter, an important document, shows the

property's ownership. The developer or builder creates a formal record with

legal force.

Payment

Schedule: The property's payment plan is described in the allotment letter. It

specifies the sum of the down payment and any additional payments needed. This

makes it possible for the buyer to plan appropriately by ensuring they know the

payment needs.

Terms

and Conditions: The terms and conditions of the agreement between the

buyer and the seller are stated in the allocation letter. This includes

specifics like the date of possession, the change in ownership, and any other

pertinent data about the acquisition of the property.

Legal

Protection: An allocation letter gives the buyer and the seller

legal protection. It guarantees that all parties are aware of the terms and

conditions of the contract and aids in avoiding future misunderstandings or

conflicts.

Required

for loan approval: An allocation letter is frequently required by lenders

as part of the loan acceptance procedure. Getting finance for the property

acquisition could be challenging without this paperwork.

When

purchasing a property, obtaining an allotment letter is essential. It is a

crucial document that stipulates the terms of the agreement between the buyer

and the seller, describes the payment plan, and offers legal protection and

proof of ownership. Before signing, ensure you have thoroughly read and understand

the allotment letter to prevent future problems or disagreements. An allotment

letter, which describes the terms of the sale, is a crucial document when

purchasing real estate. The purchase price, the selling date, and other

information like the payment schedule, the ownership of the property, and any

sale-related restrictions or conditions should all be included. The buyer and

the seller must sign the allotment letter, which should be maintained as proof

of the transaction.

Conclusion

In conclusion, while purchasing a property, an allotment letter is a crucial document that confirms the purchase and proof of ownership. It provides both the buyer and the seller with legal protection and details the contract's payment schedule, terms, and conditions. Before signing, ensure you have thoroughly read and understand the allotment letter to prevent future problems or disagreements. The allotment letter is essential when applying for a bank loan since it specifies how much you must pay the builder or housing society before the bank finances the balance. The bank lends the balance following this letter. Despite the common misconception that the sales agreement is the most crucial document in real estate transactions, the allotment letter is helpful when you are not given what you were promised.

.jpg)