All about taxes levied on property purchase

Bricksnwall Trusted Experts

When purchasing a house, the cost exceeds the asking price. Taxes are a big consideration. Different types of properties are subject to different taxes, which might affect the total cost of your investment. Understanding these taxes is critical to making educated decisions and potentially saving money. Read on to learn about the various taxes paid on property purchases and how to avoid them.

Taxes on property buying

Here is a list of some of the taxes that are levied

on property purchases.

Goods and services tax (GST)

Under the new unified tax structure established by

the federal government, under-construction properties were initially taxed at

18%. The government included a provision that permits a deduction for land

value equal to one-third of the total cost charged by a developer, effectively

lowering the GST rate for such units to 12%. However, in February 2019, the

government changed the real estate tax rate, cutting it to 5% for

under-construction apartments and 1% for affordable dwellings. It is vital to

note that governmental taxes such as stamp duty and registration charges apply

to the purchase of under-construction units.

Tax Deduction At Source (TDS)

The Finance Act of 2013 established TDS under Section 194-IA of the Income Tax Act of 1961. According to this clause, anyone purchasing a property must pay TDS to the seller for the transfer of immovable property, with the exception of agricultural land. The TDS must be reported in the name of the vendor. The government expanded Section 194-IA of the Income Tax Act to include all residential society-based charges, such as car parking fees, club membership fees, water or electricity facility fees, advance fees, maintenance fees, and any other charges associated with the transfer of immovable property for TDS levy. Since September 1, 2019, TDS has been paid at 1% on property values exceeding Rs 50 lakh.

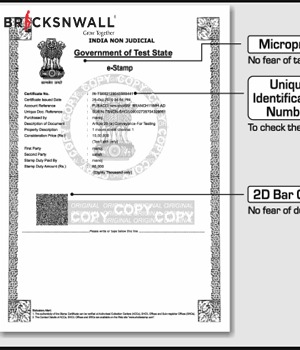

Stamp Duty

The government collects stamp duty on property transfers in the same way that it collects income or sales taxes. It typically equates to around 5% of the property's market value, though rates vary by state and can occasionally be more. The buyer must pay this duty at a specified bank or collecting location prior to property registration, with penalties for late payments. Stamp duty is calculated using government-issued ready reckoner rates and is required for legally authenticating a property sale. This tax applies to all transactions that involve the exchange of papers and the execution of property-related instruments.

Registration Fee

Registration costs are necessary expenses made

during the registration procedure, which includes documenting sale documents

with a registering officer. Section 17 of the Indian Registration Act of 1908

makes it essential by law to register papers relating to property sales,

transfers, or leases. Failure to register these documents may prevent the

owners from taking legal action. The registered paperwork is the ultimate

agreement between the parties, establishing the buyer's legitimate ownership

and protecting against potential disputes or fraud. Registration fees are

typically 1% of the agreement value, however this number can vary by state, as

decided by local government rules.

How can I save taxes on property purchases?

After discussing how taxation affects property

purchases, let's look at tax discounts and exemptions that can greatly reduce a

homebuyer's financial burden.

Tax deductions for stamp duty and registration fees

While stamp duty and registration fees normally

account for 5%-7% of the property cost, they are eligible for tax deductions

under Section 80C of the Income Tax Act of 1961. Buyers can claim up to Rs 1.5

lakh if the payments are completed within the same year of the claim, the home

is fully constructed, and it is meant for personal use rather than investment.

Tax deductions for home loans

Homebuyers who finance their acquisition with a house loan can benefit from deductions under Sections 24, 80C, and 80EE of the IT Act, subject to certain conditions:

- Interest repayment: Section 24 permits a maximum deduction of Rs 2 lakh for interest on a self-occupied property, but no restriction applies to rental buildings.

- Principal repayment: Section 80C provides a deduction of Rs 1.5 lakh on the principal amount repaid annually, subject to not selling the property within five years of possession to avoid reversal of claimed deductions.

- Additional benefit for first-time buyers: Section 80EE gives an extra Rs 50,000 deduction for first-time homebuyers if the loan amount is Rs 35 lakh or less and the property value does not exceed Rs 50 lakh.

- Joint home loan: In the event of joint loans, each co-owner can claim deductions of up to Rs 2 lakh on interest and Rs 1.5 lakh on principal under Section 80C, provided they are co-owners of the property purchased with the loan.

- Property tax applies to all lands and structures in New Delhi. It represents a percentage of the rateable value of land and buildings. The Council determines the tax rates on a yearly basis. 12.5%.

- Property tax = base value × built-up area × Age factor × type of building × category of use × floor factor.

- Tax: Long-term capital gains on the sale of residential property are taxed at 20%. The entire tax liability on a net capital gain of Rs 63, 00,000 is Rs 12,97,800. This is a substantial amount of money to be paid in taxes.