Latest Trending Blogs

Find the latest updates and expert advice on the best properties in India. Filter out the deals that are shady. Know how to find the best property offers around you.

Blogs

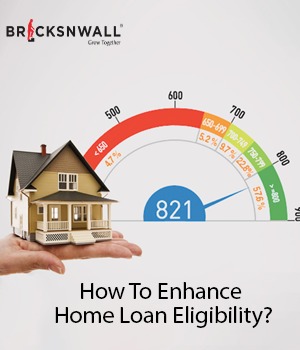

When you decide to apply for a Home loan, you will encounter multitudinous questions. Another question, analogous as from which bank to borrow capitalist, how to get a loan cheaper, is how important to borrow. generally, when buying a house, a person pays a part of the total down payment, and the rest is paid by taking a home loan. Assume the house you wish to buy costs Rs. 50 lakh. Let's say you made a down payment of rupees 8 lakh and got a home loan of Rs. 4.2 lakh more from the bank. Still, you are not demanded to gain the demanded credit. Everyone who applies for a loan has certain conditi...

Property valuation is a vital element of the real estate enterprise that holds significance for each consumer and seller. Whether you're buying a brand new home, selling belongings, or investing in real estate, expertise in the true price of the assets is critical. In this blog, we can delve into the key motives why asset valuation is critical and the way Bricksnwall can assist you in this technique.Accurate Pricing for Buyers and Sellers:For dealers, placing the right fee for their assets is essential to attract capability shoppers and make certain of a well-timed sale. Overpricing can deter shoppers, and at th...

When applying for a housing mortgage, financial establishments conduct thorough verifications to evaluate the technical and legal components of the belongings being financed. These verifications are crucial for both the lender and the borrower, making sure that the property is legally sound and meets the required technical standards. This blog submission explores the significance of technical and legal verification in housing loans.Property Assessment: During the property assessment, appraisers analyze different factors to determine its marketplace price. This consists of considering the area of the assets, its length, ...

Purchasing a home is an exciting milestone that gives one a feeling of accomplishment. However, the expense of buying a house can be intimidating for many would-be homeowners. Fortunately, home loans save the day by giving people a way to realize their ambition of owning a house. We'll examine house loans in more detail in this post, along with their principles of operation and crucial considerations for making this key financial decision.Purchase Possibility at a Fair Price: The ability to acquire a home without having to pay the whole purchase price upfront is one of the main advantages of a home loan. Instead, the lender ...

Purchasing a home is a significant financial decision, and lenders consider your credit score when approving a mortgage. Your credit score is a numerical representation of your creditworthiness, which is crucial in determining your eligibility for a home loan and interest rate. Understanding credit scores and their impact on the home-buying process is essential. Here's what homebuyers need to know about credit scores.Importance of Credit ScoresLenders use credit scores to assess the risk of lending money to borrowers. A higher credit score indicates a lower risk, making you more likely to qualify for a mortgage and secure f...

IntroductionProperty ownership is a dream for many individuals, and availing of a loan through Equated Monthly Installments (EMIs) is a popular choice for financing such investments. EMIs offer borrowers the convenience of repaying the loan amount in monthly installments over a fixed tenure. In this blog, we will discuss the steps involved in setting up an EMI for property financing, providing a comprehensive guide to assist aspiring homeowners in achieving their dreams.Understanding EMIsEquated Monthly Installments (EMIs) are a structured method of repaying a loan, ensuring borrowers can gradually pay off their debts...

A home is one of the most important purchases you will ever make. Most people must obtain a home loan to fund the purchase of a property. But if you are careless, a home loan could easily become a bad debt affecting your financial credit score and stability. In this article, we'll review some advice for avoiding bad debt with a home loan.Pick the appropriate loan.Selecting the right loan is the first step in keeping your house loan from becoming a bad debt. Loans come in various forms, including interest-only, fixed-rate, and variable-rate loans. Learning about the many loan types, comprehending them, and selecting the one...

Real estate can be a complex field, and there are many terms that you should be familiar with. Especially when you are planning to buy or sell the property. In this article, we'll discuss ten essential real estate terms that you should know.Adjustable-rate mortgage (ARM):An ARM is a type of mortgage loan where the interest rate can fluctuate over time. This means that the monthly mortgage payment can change depending on market conditions. Fluctuations are prevalent in this mortgage and the rate can increase over time. Fixed-Rate Mortgage:Type of mortgage loan where the interest rate remains constant is termed “fixed ra...

When it comes to applying for a home loan, many individuals prefer to apply with a co-applicant. There are several reasons why people choose to apply for a joint home loan. One of the main benefits is that it helps increase loan eligibility. The reason being the income of both applicants is considered. Additionally, it also helps in sharing the burden of repayment. This results in a lower interest rate on the loan. But it is important to note that choosing the right co-applicant is crucial. The same is with analyzing the impact of the loan approval and repayment process.Here are some of the individuals who can be co-applican...

The bank rate is the rate of interest at which central banks lend money to commercial banks. It is also known as the discount rate or base rate. The bank rate plays a crucial role in the economy as it affects the interest rates that commercial banks charge their customers. In this blog, we will discuss the bank rate, its significance, and its impact on the economy.Central banks use the bank rate as a tool to control the money supply in the economy. By increasing or decreasing the bank rate, central banks can influence the amount of money that commercial banks can lend to their customers. For example, if the central ba...